Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,874

- Nation

- Residence

- Axis Group

‘Leather export potential remains untapped’

Breaking News, International News & Multimedia

thedailynewnation.com

‘Leather export potential remains untapped’

28 Mar 2024, 12:00 am

Tasnuba Akhter Rifa :

The leather and leather goods industry in Bangladesh has garnered the trust of both domestic and foreign buyers owing to its combination of low prices and high quality.

Nevertheless, its export potential remains largely untapped due to a lack of international standard certification.

In response, the National Board of Revenue (NBR) has implemented a reduction in source tax on leather and leather goods exports from 1% to 0.5% until June 30, 2025.

While this move is expected to provide some relief to entrepreneurs and potentially stimulate employment, industry insiders caution that it may not significantly bolster exports.

Experts emphasise that enhancing compliance within the sector is crucial to unlocking its full export capacity.

Foreign buyers insist on satisfactory working conditions, worker safety, and environmental standards before engaging with factories, necessitating compliance with government regulations and buyer-imposed rules.

Compliance not only ensures adherence to laws and policies but also guarantees benefits for workers and employees.

According to the NBR Chairman, environmental pollution stands out as the primary challenge in the leather and leather goods sector, hindering entrepreneurs from tapping into significant global markets. Improved compliance, he argues, would lead to an increase in exports of leather and leather goods.

“The main problem in the leather and leather goods sector is environmental pollution. That’s why entrepreneurs are not able to capture big markets around the world.

If compliance improves exports of leather and leather goods will increase.” said NBR Chairman.

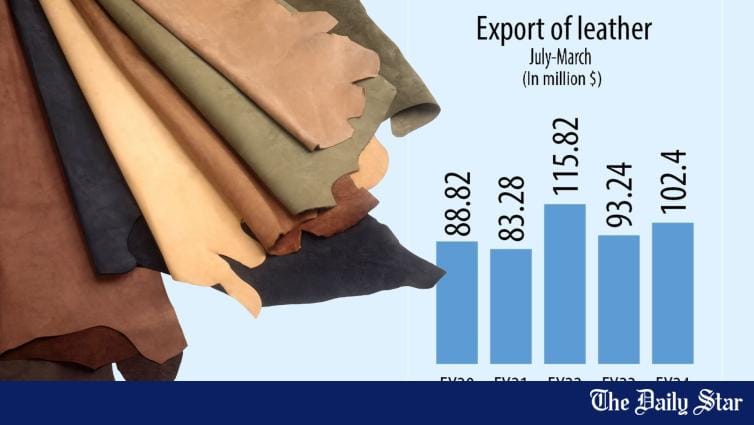

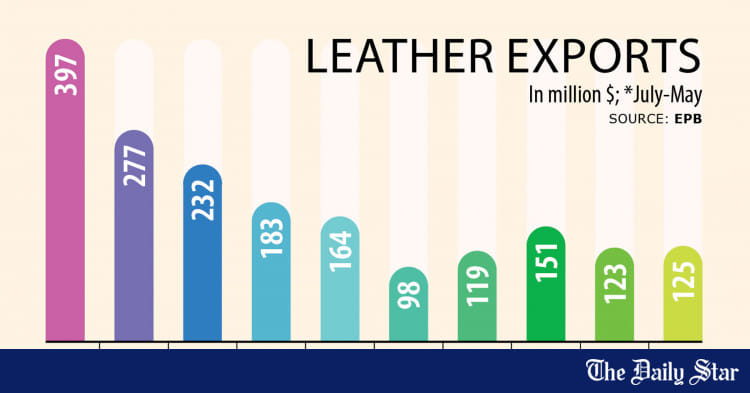

Despite being the country’s second-largest export product, the leather and leather goods sector faces hurdles. In the current financial year (2023-24), it aims for exports totaling $13 billion.

However, exports during the first eight months (July-February) amounted to approximately $71 crore, marking a 14.38% decrease compared to the same period last year.

In the previous financial year (2022-23), exports reached $122 crore, down about 2% from the preceding year.

During a pre-budget discussion in February, the Leather Goods and Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB) highlighted various challenges in the sector and proposed reducing the source tax on leather goods and footwear exports from 1% to 0.5%.

LFMEAB Senior Vice President Mohammad Nazmul Hasan expressed optimism to The New Nation regarding the government’s initiative, anticipating an increase in leather goods exports and the creation of new jobs.

However, he highlighted challenges such as decreased demand for these products in the international market and increased production costs in the domestic market, especially with a 45% rise in sea transportation costs due to fuel price hikes and Middle East conflicts.

Contrary to the reduction in incentives, Dr. Mahfuz Kabir, a Senior Research Fellow and economist at BIISS, argued that such measures wouldn’t facilitate market entry into Europe or other regions, attributing the sector’s export challenges primarily to compliance issues.

“There is no benefit in reducing the incentive in this sector. Even if we reduce it, we will not be able to enter the European or other markets.

We are not able to capture the market due to compliance issues.” said Dr. Mahfuz Kabir, BIISS Senior Research Fellow and Economist.

He emphasised environmental pollution as a significant hurdle, citing the incomplete functionality of the central effluent treatment plant (CETP) at the planned leather industrial city in Hemayetpur, Savar.

This pollution impedes tanneries from obtaining international standard certification, thereby hindering Bangladesh from fully capitalising on its export potential.

In order to sell leather and leather goods at a good price to international brands, one has to have the certification of the Leather Working Group (LWG), a global leather industry organisation.

It is known that only six establishments in Bangladesh have LWG certification.

Domestic entrepreneurs export leather and leather goods to markets where there is no brand value. Each leather processed in a non-LWG-certified factory in the country is being exported for a minimum of 45 cents to $1.60.

Tasnuba Akhter Rifa :

The leather and leather goods industry in Bangladesh has garnered the trust of both domestic and foreign buyers owing to its combination of low prices and high quality.

Nevertheless, its export potential remains largely untapped due to a lack of international standard certification.

In response, the National Board of Revenue (NBR) has implemented a reduction in source tax on leather and leather goods exports from 1% to 0.5% until June 30, 2025.

While this move is expected to provide some relief to entrepreneurs and potentially stimulate employment, industry insiders caution that it may not significantly bolster exports.

Experts emphasise that enhancing compliance within the sector is crucial to unlocking its full export capacity.

Foreign buyers insist on satisfactory working conditions, worker safety, and environmental standards before engaging with factories, necessitating compliance with government regulations and buyer-imposed rules.

Compliance not only ensures adherence to laws and policies but also guarantees benefits for workers and employees.

According to the NBR Chairman, environmental pollution stands out as the primary challenge in the leather and leather goods sector, hindering entrepreneurs from tapping into significant global markets. Improved compliance, he argues, would lead to an increase in exports of leather and leather goods.

“The main problem in the leather and leather goods sector is environmental pollution. That’s why entrepreneurs are not able to capture big markets around the world.

If compliance improves exports of leather and leather goods will increase.” said NBR Chairman.

Despite being the country’s second-largest export product, the leather and leather goods sector faces hurdles. In the current financial year (2023-24), it aims for exports totaling $13 billion.

However, exports during the first eight months (July-February) amounted to approximately $71 crore, marking a 14.38% decrease compared to the same period last year.

In the previous financial year (2022-23), exports reached $122 crore, down about 2% from the preceding year.

During a pre-budget discussion in February, the Leather Goods and Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB) highlighted various challenges in the sector and proposed reducing the source tax on leather goods and footwear exports from 1% to 0.5%.

LFMEAB Senior Vice President Mohammad Nazmul Hasan expressed optimism to The New Nation regarding the government’s initiative, anticipating an increase in leather goods exports and the creation of new jobs.

However, he highlighted challenges such as decreased demand for these products in the international market and increased production costs in the domestic market, especially with a 45% rise in sea transportation costs due to fuel price hikes and Middle East conflicts.

Contrary to the reduction in incentives, Dr. Mahfuz Kabir, a Senior Research Fellow and economist at BIISS, argued that such measures wouldn’t facilitate market entry into Europe or other regions, attributing the sector’s export challenges primarily to compliance issues.

“There is no benefit in reducing the incentive in this sector. Even if we reduce it, we will not be able to enter the European or other markets.

We are not able to capture the market due to compliance issues.” said Dr. Mahfuz Kabir, BIISS Senior Research Fellow and Economist.

He emphasised environmental pollution as a significant hurdle, citing the incomplete functionality of the central effluent treatment plant (CETP) at the planned leather industrial city in Hemayetpur, Savar.

This pollution impedes tanneries from obtaining international standard certification, thereby hindering Bangladesh from fully capitalising on its export potential.

In order to sell leather and leather goods at a good price to international brands, one has to have the certification of the Leather Working Group (LWG), a global leather industry organisation.

It is known that only six establishments in Bangladesh have LWG certification.

Domestic entrepreneurs export leather and leather goods to markets where there is no brand value. Each leather processed in a non-LWG-certified factory in the country is being exported for a minimum of 45 cents to $1.60.