Saif

Senior Member

- Messages

- 15,397

- Nation

- Axis Group

Japanese funds to revive closed sugar mills

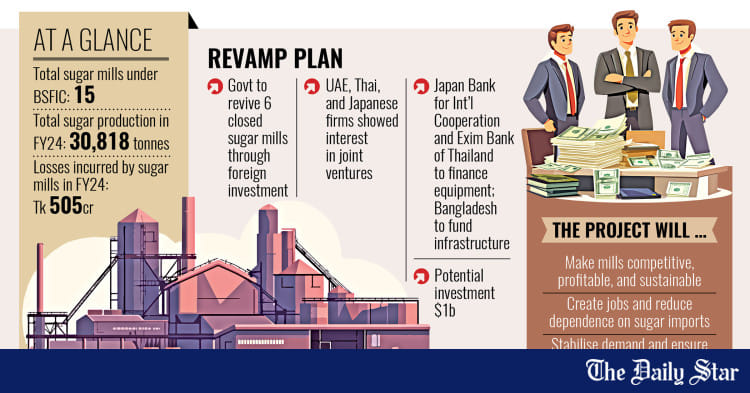

The government has launched an initiative to modernise and revive six shuttered sugar mills, aiming to transform them into profitable enterprises through public-private partnerships and advanced technology.

Japanese funds to revive closed sugar mills

The government has launched an initiative to modernise and revive six shuttered sugar mills, aiming to transform them into profitable enterprises through public-private partnerships and advanced technology.

Citing operational inefficiencies, the mills were shut down by the previous Awami League government in December 2020.

According to the Ministry of Industries, the Bangladesh Sugar and Food Industries Corporation (BSFIC) is holding discussions with international firms to develop a modernisation and rationalisation plan for these units.

This brings forward a proposal on forming a joint venture and a potential finance by Japan Bank for International Cooperation (JBIC) and the Export-Import Bank of Thailand (EXIM). The majority of the fund may come from JBIC.

On March 16, the ministry sought the opinion of the Bangladesh Investment Development Authority (Bida) on the initiative as private and foreign direct investment would be involved.

In July last year, it was announced that a memorandum of understanding (MoU) had been signed between the BSFIC and the controversial S Alam Group, aimed at modernising the state-run sugar mills.

However, following the ouster of the Awami League government in August last year and the S Alam Group landing into hot water subsequently, the interim government walked away from that deal.

Last month, United Arab Emirates-based Sharkara International (FZC), Thailand's Sutech Engineering Company Ltd, and Japan's Marubeni Protechs Corporation presented a proposal to the industries ministry, expressing interest in forming a joint venture to overhaul the factories.

In October 2019, the BSFIC signed a memorandum of understanding with the three to establish energy-efficient, technology-based and environmentally friendly sugarcane and export-oriented alcohol industries in Bangladesh.

But the proposal remained stuck at the Prime Minister's Office since.

An industries ministry official said the latest proposal appears suitable for modernising shuttered sugar mills and making them profitable.

"We have already shared a letter with Bida as their opinion is mandatory for such investments," the official added. "The sector has the potential to be profitable again, but it requires urgent technological and management improvements."

Ashik Chowdhury, executive chairman of the Bida, told The Daily Star that it was not the government's role to engage in business, stressing that loss-making entities should be managed by the private sector to enhance competitiveness and efficiency.

He highlighted that privatising the sugar industry would save the government significant funds lost due to inefficiencies. "The private sector is better equipped to run such industries efficiently," he said.

As such, Chowdhury welcomed the Ministry of Industries' efforts and confirmed that the Bida was actively collaborating with the ministry to attract foreign investors to take over and manage these businesses.

According to a letter sent from the Ministry of Industries to Bida, the proposed project would see the revival of the six closed sugar mills either through full government ownership or a joint venture between the BSFIC and private investors.

The Japan Bank for International Cooperation (JBIC) and the Export-Import Bank of Thailand (EXIM) will provide loans for the purchase of equipment and designs from abroad while the Bangladesh government will fund local construction and infrastructure.

Under the proposal, Sharkara, Sutech, and Marubeni will contribute technological expertise, modern equipment, and management services for the mills.

A local representative of the investors, speaking on condition of anonymity, told The Daily Star that reviving the sugar mills would support local sugarcane farmers by ensuring stable demand for their crops.

"A well-functioning local industry can provide farmers with fair prices and a consistent market, boosting the agricultural sector," the representative said, adding that investors might inject around $1 billion and focus on creating a separate world-class food packaging industry if the government acts swiftly.

"The revival of sugar mills will not only generate employment but also benefit thousands of farmers who depend on sugarcane cultivation for their livelihoods."

Sources at the Ministry of Industries said that the government is currently reviewing proposals from the international consortium to finalise the structure of the partnership and financing agreements.

The Bida is also assessing the investment potential and regulatory aspects of the project.

Mohammad Mujibur Rahman, secretary to the BSFIC, said he was not fully aware of the latest updates on the initiative but reaffirmed that their goal is to create a sustainable and competitive sugar industry that benefits all stakeholders.

"If successfully implemented, this project could mark the beginning of a new era for the country's sugar mills, making them more efficient, competitive, and profitable," he concluded.

Bangladesh's sugar industry has long faced challenges such as outdated machinery, declining demand for locally produced sugar, and financial losses. As a result, the BSFIC, which oversees 15 sugar mills in the country, has been burdened with heavy debt.

The modernisation project is expected to bring several economic benefits, including creating jobs and reducing dependence on imported sugar. However, experts argue that the remaining nine mills will continue to suffer losses unless modernisation efforts are undertaken.

The government has launched an initiative to modernise and revive six shuttered sugar mills, aiming to transform them into profitable enterprises through public-private partnerships and advanced technology.

Citing operational inefficiencies, the mills were shut down by the previous Awami League government in December 2020.

According to the Ministry of Industries, the Bangladesh Sugar and Food Industries Corporation (BSFIC) is holding discussions with international firms to develop a modernisation and rationalisation plan for these units.

This brings forward a proposal on forming a joint venture and a potential finance by Japan Bank for International Cooperation (JBIC) and the Export-Import Bank of Thailand (EXIM). The majority of the fund may come from JBIC.

On March 16, the ministry sought the opinion of the Bangladesh Investment Development Authority (Bida) on the initiative as private and foreign direct investment would be involved.

In July last year, it was announced that a memorandum of understanding (MoU) had been signed between the BSFIC and the controversial S Alam Group, aimed at modernising the state-run sugar mills.

However, following the ouster of the Awami League government in August last year and the S Alam Group landing into hot water subsequently, the interim government walked away from that deal.

Last month, United Arab Emirates-based Sharkara International (FZC), Thailand's Sutech Engineering Company Ltd, and Japan's Marubeni Protechs Corporation presented a proposal to the industries ministry, expressing interest in forming a joint venture to overhaul the factories.

In October 2019, the BSFIC signed a memorandum of understanding with the three to establish energy-efficient, technology-based and environmentally friendly sugarcane and export-oriented alcohol industries in Bangladesh.

But the proposal remained stuck at the Prime Minister's Office since.

An industries ministry official said the latest proposal appears suitable for modernising shuttered sugar mills and making them profitable.

"We have already shared a letter with Bida as their opinion is mandatory for such investments," the official added. "The sector has the potential to be profitable again, but it requires urgent technological and management improvements."

Ashik Chowdhury, executive chairman of the Bida, told The Daily Star that it was not the government's role to engage in business, stressing that loss-making entities should be managed by the private sector to enhance competitiveness and efficiency.

He highlighted that privatising the sugar industry would save the government significant funds lost due to inefficiencies. "The private sector is better equipped to run such industries efficiently," he said.

As such, Chowdhury welcomed the Ministry of Industries' efforts and confirmed that the Bida was actively collaborating with the ministry to attract foreign investors to take over and manage these businesses.

According to a letter sent from the Ministry of Industries to Bida, the proposed project would see the revival of the six closed sugar mills either through full government ownership or a joint venture between the BSFIC and private investors.

The Japan Bank for International Cooperation (JBIC) and the Export-Import Bank of Thailand (EXIM) will provide loans for the purchase of equipment and designs from abroad while the Bangladesh government will fund local construction and infrastructure.

Under the proposal, Sharkara, Sutech, and Marubeni will contribute technological expertise, modern equipment, and management services for the mills.

A local representative of the investors, speaking on condition of anonymity, told The Daily Star that reviving the sugar mills would support local sugarcane farmers by ensuring stable demand for their crops.

"A well-functioning local industry can provide farmers with fair prices and a consistent market, boosting the agricultural sector," the representative said, adding that investors might inject around $1 billion and focus on creating a separate world-class food packaging industry if the government acts swiftly.

"The revival of sugar mills will not only generate employment but also benefit thousands of farmers who depend on sugarcane cultivation for their livelihoods."

Sources at the Ministry of Industries said that the government is currently reviewing proposals from the international consortium to finalise the structure of the partnership and financing agreements.

The Bida is also assessing the investment potential and regulatory aspects of the project.

Mohammad Mujibur Rahman, secretary to the BSFIC, said he was not fully aware of the latest updates on the initiative but reaffirmed that their goal is to create a sustainable and competitive sugar industry that benefits all stakeholders.

"If successfully implemented, this project could mark the beginning of a new era for the country's sugar mills, making them more efficient, competitive, and profitable," he concluded.

Bangladesh's sugar industry has long faced challenges such as outdated machinery, declining demand for locally produced sugar, and financial losses. As a result, the BSFIC, which oversees 15 sugar mills in the country, has been burdened with heavy debt.

The modernisation project is expected to bring several economic benefits, including creating jobs and reducing dependence on imported sugar. However, experts argue that the remaining nine mills will continue to suffer losses unless modernisation efforts are undertaken.