Saif

Senior Member

- Messages

- 15,397

- Nation

- Axis Group

The anatomy of corruption in BD

Of late, the media in Bangladesh is abuzz with news of high profile cases of corruption coming in quick succession, sometimes simultaneously. Senior officials, both in office and retired, have been implicated in allegations of corrupt practices and for amassing wealth well beyond their known source

The anatomy of corruption in BD

HASNAT ABDUL HYE

Published :

Jul 15, 2024 21:42

Updated :

Jul 15, 2024 21:42

Of late, the media in Bangladesh is abuzz with news of high profile cases of corruption coming in quick succession, sometimes simultaneously. Senior officials, both in office and retired, have been implicated in allegations of corrupt practices and for amassing wealth well beyond their known sources of income. Moveable assets and immoveable properties have allegedly been acquired by officials and shown in the name of near relatives, besides their own. Assets include money deposited in bank accounts, gold in lockers of banks and stocks of various companies, while properties include apartments in metropolitan cities and land all over Bangladesh. Among the cases made public, there are quite a few where land acquired with ill gotten money have been converted into 'resorts', an investment of preferred choice by the noveau riche of the errant kind. It is suspected the alleged offenders may also have immoveable properties abroad, Canada and Malaysia for instance, and cash stashed away in offshore safe havens.

Sensational as the cases of alleged corruptions are, it has long been a public knowledge that many departments under various ministries are mired deep in corruption.

Government officials and functionaries at all levels are alleged to be indulging in corrupt practices of one kind or another for personal gains. So far some officials of only a few ministries and departments like NBR of ministry of finance, the health directorate of the ministry of health, public service commission (PSC) of the ministry of public administration and police department of the ministry of home, have come under the radar of investigation by Anti-Corruption Commission (ACC). Given the widespread and longstanding nature of corruption that has been flagged by independent authorities like Transparency International (TI) it is suspected that almost all branches of government are now wallowing in corruption in degrees allowed by their writ. In this respect there appears to be no scope for any government entity in Bangladesh to adopt a holier than thou attitude visa vis other departments. However, it will be a sweeping generalisation to say that everyone in government service is or was corrupt. There have been honourable exceptions, as is the case with other cases of unethical conduct. But as the rot of corruption set in and it festered like a malignant wound, the dragnet spread wider, embracing an ever increasing number of offenders. Apart from public perception, the unpleasant truth of corruption running riot across the whole spectrum of government could not be beyond the knowledge of higher authorities. Whatever may be the causes of their failure to call the corrupt elements to account until now, the recent cases of high profile anti-corruption probes indicate a clear policy of cleaning up the proverbial Aegean stable. It remains to be seen whether the current spate of anti- corruption cases will be sustained, morphing into a zero tolerance policy for the economic crime of the gravest kind. When it comes to promoting good governance, cleansing administration of malpractices, including corruption, take a seat right at front and centre. The current high profile cases against some senior officials give hope that at long last the campaign launched has political will behind it.

CAUSES AND CONSEQUENCES OF CORRUPTION: All cases of corruption are not the same. They do not stem from the same causes and do not have same consequences. The causes and consequences of different types of corruption constitute the 'anatomy' of the malignancy (corruption) in the body eco-politic that will be discussed in this section, using mostly the cases of alleged corruption that have made 'hot news' in recent weeks. Though limited in number (the alleged cases of corruption), the examples can be used as case studies of corruption in general with wider application.

Three cases of alleged corruption have been made public in which senior officials of National Bureau of Revenue (NBR) have been implicated. None of them were caught at the time of committing the venial act. All the alleged offenders were given away by their ill gotten wealth, either through ostentatious style of living or by the sheer size and value of assets. The advantage of being a country of limited geography and high population is that nothing remains secret for long. Tongues start to wag and rumour mill continue to churn stories of high fliers whose ballast is ill gotten money. No secret intelligence is required to unearth cases of corruption in Bangladesh. But this is one aspect of the anatomy of corruption. The most important part is how did the NBR officials on the dock indulge in corruption in the first place? For the answer one has to look at the responsibility and power of NBR officials. They are entrusted with the task of collecting taxes, VAT and fees from individuals and business and industrial entities liable to pay these under existing rules and provisions of laws. Those who want to evade paying their due may resort to bribery with cash, either directly or through an intermediary. If the NBR officials responsible for determining the tax due from taxpayers agree to the desired evasion, fully or partially, in consideration of money paid, an unholy contract is signed. Tax evasion takes place and money changes hands. This is the most common case of corruption that may be resorted to by a NBR official. When this becomes regular and is institutionalised everyone in the office may get his/her cut. Wherever an official of NBR is alleged to take bribe this is how it takes place. The case of Mr Motiur of NBR is slightly different as he reportedly made money through insider information to buy stocks in companies to which he was privy. Illegal as such an act is, it will be interesting to see if his wealth can be accounted for by this source of earning money alone or whether this is a ploy to cover up income through the classic means mentioned above. In all cases where NBR officials are implicated in cases of corruption they invariably are seen to have misused their discretionary power.

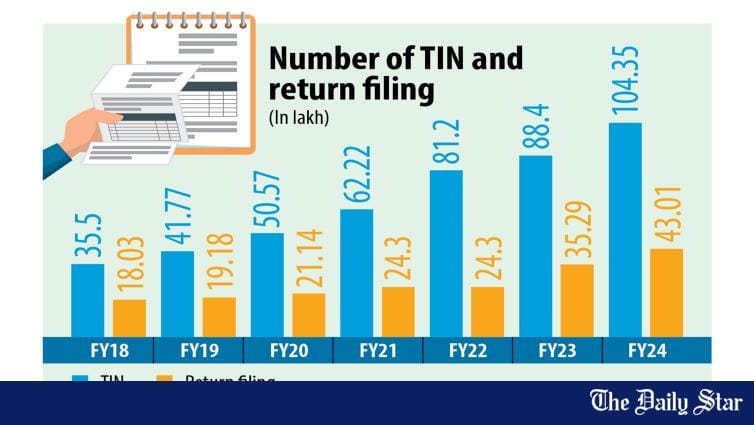

The consequences of allowing tax evasion to take place are obvious. To the degree and extent tax evasion is allowed for monetary consideration by NBR officials there is a consequent shortfall in revenue collection. The entire economy suffers from inadequate resource mobilisation, forcing government to borrow money to balance the budget. The tax-GDP ratio languishing at the paltry rate of 9 per cent can be mostly explained by this.

The second case of corruption that have made news in recent weeks involve very senior police officials, including the former head of the police department, now retired. In these instances also, the officials in question were given away by their wealth and assets. They are alleged to have assets in banks and immoveable properties (apartments and land) well beyond their known sources of income. How do police officials like the ones in the news make oodles of money? It is alleged that one source of making illegal money by police is the misuse or abuse of power by police. Police has been given immense power under law over the liberty and property of people and they have discretion in using these selectively. For instance, they can arrest anyone on suspicion under section 54 of criminal procedure code or include/exclude names in FIR of heinous cases. They also have the right to take cognisance of an offence. In short, personnel of no other department of government has as much and as wide a power as police has. With so much power at their disposal some of them may be tempted to use it for personal gains. The police officials who are being investigated and have made news may have misused and abused their power while in office quite liberally. Like the NBR officials, they too are guilty of misusing their power, though their powers differ and scope of work vary.

It is not so much the economy as the society that suffers when police misuse their power. The rule of law is undermined or made short shrift of when bias is seen in the conduct of police in applying rules and laws selectively. Good governance has a great deal to do with rule of law and therefore use of power vested in police matters very importantly.

The third case of alleged corruption concerns some doctors under the ministry of health. They are alleged to have made money illegally by using their power in matters of purchase and appointments. Purchases increase when there are development projects and tenders are called. Suppliers and contractors vie with one another to get the order for which they don't think too much to offer bribe. Here too, the cause of corruption is misuse of power as rules may be bent to accommodate preferred parties. The consequence of misuse of power by officials in health ministry results in both high cost paid for items purchased and diminished service delivery to the public because of the increase in out of pocket expenses for relatives of patients.

The fourth case of alleged corruption that has made news involves officials and staff of PSC. The former chairman of public service commission, a former professor of a university, is reportedly among the suspects. They are accused of divulging question papers for BCS examination of a certain year. Here too, the cause of corruption is abuse of power that resulted in leaking official secrets (question papers) for pecuniary gains of the corrupt. The consequence of this misuse of power is to society, in so far as those who contested honestly might have lost in competition to candidates less meritorious than them. The quality of service provided by government may have been compromised by this loss of talent in public service. Another result of this alleged offense is the undermining of trust in the neutrality of public service commission.

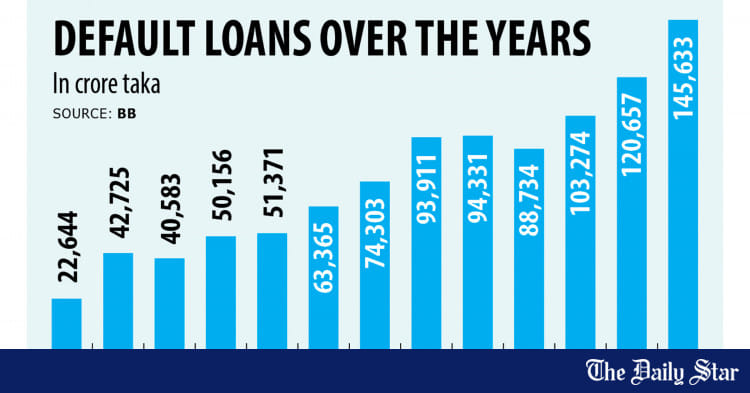

The fifth case of corruption in the news relate to a state-owned bank whose chairman made thousand crores of money by sanctioning huge loans to parties having little or no credible credentials. This is just a tip of the ice berg as most of the institutions in the financial sector are floundering because of the egregious growth of non- performing loans (NPLs) and widespread incidence of self-serving management. In many cases both bank officials and directors of boards are guilty of misuse of power or failure to exercise due diligence.

CONCLUSION: The above discussion on the anatomy of corruption, causes and consequences, has been confined to cases that pertain to recent news in media. There is no doubt that corruption is taking place in other ministries and departments under them in varying degrees. If misuse of power happened in the reported cases in police, health, NBR and PSC, other departments and agencies in the government cannot be aseptic to this malaise. However, there is one case of misuse of power that requires elaboration as it has become endemic to the entire system of governance. In a great variety of cases and at all levels of government, services to which public are entitled free of charges, monetary payment is demanded by government functionaries. This kind of rent seeking is pervasive and has almost become routine. Universal in nature, this practice has become firmly entrenched.

To read the rest of the news, please click on the link above.

HASNAT ABDUL HYE

Published :

Jul 15, 2024 21:42

Updated :

Jul 15, 2024 21:42

Of late, the media in Bangladesh is abuzz with news of high profile cases of corruption coming in quick succession, sometimes simultaneously. Senior officials, both in office and retired, have been implicated in allegations of corrupt practices and for amassing wealth well beyond their known sources of income. Moveable assets and immoveable properties have allegedly been acquired by officials and shown in the name of near relatives, besides their own. Assets include money deposited in bank accounts, gold in lockers of banks and stocks of various companies, while properties include apartments in metropolitan cities and land all over Bangladesh. Among the cases made public, there are quite a few where land acquired with ill gotten money have been converted into 'resorts', an investment of preferred choice by the noveau riche of the errant kind. It is suspected the alleged offenders may also have immoveable properties abroad, Canada and Malaysia for instance, and cash stashed away in offshore safe havens.

Sensational as the cases of alleged corruptions are, it has long been a public knowledge that many departments under various ministries are mired deep in corruption.

Government officials and functionaries at all levels are alleged to be indulging in corrupt practices of one kind or another for personal gains. So far some officials of only a few ministries and departments like NBR of ministry of finance, the health directorate of the ministry of health, public service commission (PSC) of the ministry of public administration and police department of the ministry of home, have come under the radar of investigation by Anti-Corruption Commission (ACC). Given the widespread and longstanding nature of corruption that has been flagged by independent authorities like Transparency International (TI) it is suspected that almost all branches of government are now wallowing in corruption in degrees allowed by their writ. In this respect there appears to be no scope for any government entity in Bangladesh to adopt a holier than thou attitude visa vis other departments. However, it will be a sweeping generalisation to say that everyone in government service is or was corrupt. There have been honourable exceptions, as is the case with other cases of unethical conduct. But as the rot of corruption set in and it festered like a malignant wound, the dragnet spread wider, embracing an ever increasing number of offenders. Apart from public perception, the unpleasant truth of corruption running riot across the whole spectrum of government could not be beyond the knowledge of higher authorities. Whatever may be the causes of their failure to call the corrupt elements to account until now, the recent cases of high profile anti-corruption probes indicate a clear policy of cleaning up the proverbial Aegean stable. It remains to be seen whether the current spate of anti- corruption cases will be sustained, morphing into a zero tolerance policy for the economic crime of the gravest kind. When it comes to promoting good governance, cleansing administration of malpractices, including corruption, take a seat right at front and centre. The current high profile cases against some senior officials give hope that at long last the campaign launched has political will behind it.

CAUSES AND CONSEQUENCES OF CORRUPTION: All cases of corruption are not the same. They do not stem from the same causes and do not have same consequences. The causes and consequences of different types of corruption constitute the 'anatomy' of the malignancy (corruption) in the body eco-politic that will be discussed in this section, using mostly the cases of alleged corruption that have made 'hot news' in recent weeks. Though limited in number (the alleged cases of corruption), the examples can be used as case studies of corruption in general with wider application.

Three cases of alleged corruption have been made public in which senior officials of National Bureau of Revenue (NBR) have been implicated. None of them were caught at the time of committing the venial act. All the alleged offenders were given away by their ill gotten wealth, either through ostentatious style of living or by the sheer size and value of assets. The advantage of being a country of limited geography and high population is that nothing remains secret for long. Tongues start to wag and rumour mill continue to churn stories of high fliers whose ballast is ill gotten money. No secret intelligence is required to unearth cases of corruption in Bangladesh. But this is one aspect of the anatomy of corruption. The most important part is how did the NBR officials on the dock indulge in corruption in the first place? For the answer one has to look at the responsibility and power of NBR officials. They are entrusted with the task of collecting taxes, VAT and fees from individuals and business and industrial entities liable to pay these under existing rules and provisions of laws. Those who want to evade paying their due may resort to bribery with cash, either directly or through an intermediary. If the NBR officials responsible for determining the tax due from taxpayers agree to the desired evasion, fully or partially, in consideration of money paid, an unholy contract is signed. Tax evasion takes place and money changes hands. This is the most common case of corruption that may be resorted to by a NBR official. When this becomes regular and is institutionalised everyone in the office may get his/her cut. Wherever an official of NBR is alleged to take bribe this is how it takes place. The case of Mr Motiur of NBR is slightly different as he reportedly made money through insider information to buy stocks in companies to which he was privy. Illegal as such an act is, it will be interesting to see if his wealth can be accounted for by this source of earning money alone or whether this is a ploy to cover up income through the classic means mentioned above. In all cases where NBR officials are implicated in cases of corruption they invariably are seen to have misused their discretionary power.

The consequences of allowing tax evasion to take place are obvious. To the degree and extent tax evasion is allowed for monetary consideration by NBR officials there is a consequent shortfall in revenue collection. The entire economy suffers from inadequate resource mobilisation, forcing government to borrow money to balance the budget. The tax-GDP ratio languishing at the paltry rate of 9 per cent can be mostly explained by this.

The second case of corruption that have made news in recent weeks involve very senior police officials, including the former head of the police department, now retired. In these instances also, the officials in question were given away by their wealth and assets. They are alleged to have assets in banks and immoveable properties (apartments and land) well beyond their known sources of income. How do police officials like the ones in the news make oodles of money? It is alleged that one source of making illegal money by police is the misuse or abuse of power by police. Police has been given immense power under law over the liberty and property of people and they have discretion in using these selectively. For instance, they can arrest anyone on suspicion under section 54 of criminal procedure code or include/exclude names in FIR of heinous cases. They also have the right to take cognisance of an offence. In short, personnel of no other department of government has as much and as wide a power as police has. With so much power at their disposal some of them may be tempted to use it for personal gains. The police officials who are being investigated and have made news may have misused and abused their power while in office quite liberally. Like the NBR officials, they too are guilty of misusing their power, though their powers differ and scope of work vary.

It is not so much the economy as the society that suffers when police misuse their power. The rule of law is undermined or made short shrift of when bias is seen in the conduct of police in applying rules and laws selectively. Good governance has a great deal to do with rule of law and therefore use of power vested in police matters very importantly.

The third case of alleged corruption concerns some doctors under the ministry of health. They are alleged to have made money illegally by using their power in matters of purchase and appointments. Purchases increase when there are development projects and tenders are called. Suppliers and contractors vie with one another to get the order for which they don't think too much to offer bribe. Here too, the cause of corruption is misuse of power as rules may be bent to accommodate preferred parties. The consequence of misuse of power by officials in health ministry results in both high cost paid for items purchased and diminished service delivery to the public because of the increase in out of pocket expenses for relatives of patients.

The fourth case of alleged corruption that has made news involves officials and staff of PSC. The former chairman of public service commission, a former professor of a university, is reportedly among the suspects. They are accused of divulging question papers for BCS examination of a certain year. Here too, the cause of corruption is abuse of power that resulted in leaking official secrets (question papers) for pecuniary gains of the corrupt. The consequence of this misuse of power is to society, in so far as those who contested honestly might have lost in competition to candidates less meritorious than them. The quality of service provided by government may have been compromised by this loss of talent in public service. Another result of this alleged offense is the undermining of trust in the neutrality of public service commission.

The fifth case of corruption in the news relate to a state-owned bank whose chairman made thousand crores of money by sanctioning huge loans to parties having little or no credible credentials. This is just a tip of the ice berg as most of the institutions in the financial sector are floundering because of the egregious growth of non- performing loans (NPLs) and widespread incidence of self-serving management. In many cases both bank officials and directors of boards are guilty of misuse of power or failure to exercise due diligence.

CONCLUSION: The above discussion on the anatomy of corruption, causes and consequences, has been confined to cases that pertain to recent news in media. There is no doubt that corruption is taking place in other ministries and departments under them in varying degrees. If misuse of power happened in the reported cases in police, health, NBR and PSC, other departments and agencies in the government cannot be aseptic to this malaise. However, there is one case of misuse of power that requires elaboration as it has become endemic to the entire system of governance. In a great variety of cases and at all levels of government, services to which public are entitled free of charges, monetary payment is demanded by government functionaries. This kind of rent seeking is pervasive and has almost become routine. Universal in nature, this practice has become firmly entrenched.

To read the rest of the news, please click on the link above.