Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,874

- Nation

- Residence

- Axis Group

Are we becoming incorrigibly corrupt?

Latest CPI score paints a sorry picture of Bangladesh’s progress

Are we becoming incorrigibly corrupt?

Latest CPI score paints a sorry picture of Bangladesh’s progress

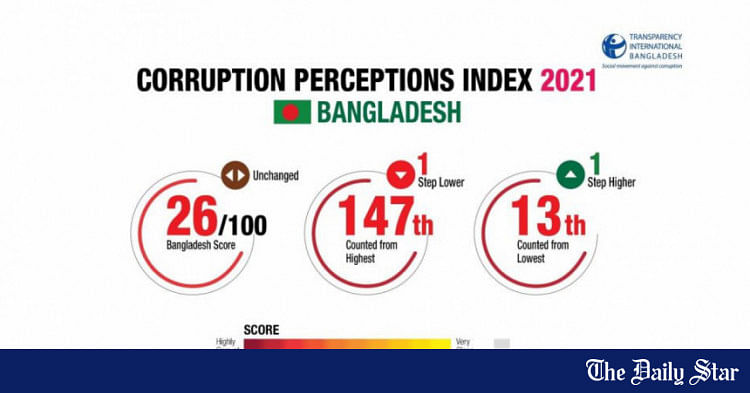

The latest edition of the Corruption Perceptions Index (CPI) by Transparency International (TI) is now out. And just as predictable as this publication is at this time of the year, it pains us to see that Bangladesh's performance in this annual undertaking by the global corruption watchdog has become equally predictable. In the 2021 edition, the country has once again scored 26 out of 100—the same as in 2020, 2019 and 2018. Once again, we have ranked second-worst in South Asia, above only Afghanistan, and third-lowest among 31 countries in the Asia Pacific region. In fact, a 10-year CPI trend analysis shows that Bangladesh has stagnated in the neighbourhood of the same score over the last decade, meaning there's been no real progress during the two latest tenures of this government.

Since the CPI measures "perceived" levels of public-sector corruption, we may soon see a firm rebuttal from the government, disputing this badge of shame. True, there are questions about the methods used for measuring corruption. But one doesn't need TI to reaffirm what we already know to be true: that corruption has permeated every aspect of our lives, ranging from bribery, use of public office for private gain, diversion of public funds, and nepotism in public sector appointments to red tape and ineffective mechanisms for corruption control—to name a few areas of measurement cited by TI. We have seen repeatedly how a section of officials and politically influential people, including public representatives, indulged in various forms of corruption using their connections and poor institutional safeguards, and how they have been let go. In fact, the all-encompassing nature of corruption means that spillover effects of public sector corruption have ruined any chance of progress in the private sector too.

As a consequence, corruption has become a way of life. We can't get rid of it, but since the system has become so crooked, we can't live without it either. A key factor in the non-delivery of the pledges of "zero-tolerance" for corruption, according to the chief of the Bangladeshi chapter of TI, is the intrinsic linkage among politics, money and corruption, causing a disconnect of public decisions and actions from the common people's interests. "Without a paradigm shift in our political culture to put public interest first, replacing the practice of treating political affiliation as a licence for abuse of power, corruption cannot be controlled," he says. We cannot agree more.

To see a change in this scenario, we need drastic reforms, starting with building a political consensus on the need for insulating public institutions from the influence of politics, money and criminality. The Anti-Corruption Commission (ACC) must be empowered to do its job. There should also be legal provisions to manage conflict of interest transparently, depoliticising institutions of accountability, and establishing professional integrity and impartiality of all vital institutions, including public service, administration and law enforcement agencies. We can't continue to repeat the mistakes of the past or allow the corrupt elements to eat away at the hard-earned achievements of our nation.

The latest edition of the Corruption Perceptions Index (CPI) by Transparency International (TI) is now out. And just as predictable as this publication is at this time of the year, it pains us to see that Bangladesh's performance in this annual undertaking by the global corruption watchdog has become equally predictable. In the 2021 edition, the country has once again scored 26 out of 100—the same as in 2020, 2019 and 2018. Once again, we have ranked second-worst in South Asia, above only Afghanistan, and third-lowest among 31 countries in the Asia Pacific region. In fact, a 10-year CPI trend analysis shows that Bangladesh has stagnated in the neighbourhood of the same score over the last decade, meaning there's been no real progress during the two latest tenures of this government.

Since the CPI measures "perceived" levels of public-sector corruption, we may soon see a firm rebuttal from the government, disputing this badge of shame. True, there are questions about the methods used for measuring corruption. But one doesn't need TI to reaffirm what we already know to be true: that corruption has permeated every aspect of our lives, ranging from bribery, use of public office for private gain, diversion of public funds, and nepotism in public sector appointments to red tape and ineffective mechanisms for corruption control—to name a few areas of measurement cited by TI. We have seen repeatedly how a section of officials and politically influential people, including public representatives, indulged in various forms of corruption using their connections and poor institutional safeguards, and how they have been let go. In fact, the all-encompassing nature of corruption means that spillover effects of public sector corruption have ruined any chance of progress in the private sector too.

As a consequence, corruption has become a way of life. We can't get rid of it, but since the system has become so crooked, we can't live without it either. A key factor in the non-delivery of the pledges of "zero-tolerance" for corruption, according to the chief of the Bangladeshi chapter of TI, is the intrinsic linkage among politics, money and corruption, causing a disconnect of public decisions and actions from the common people's interests. "Without a paradigm shift in our political culture to put public interest first, replacing the practice of treating political affiliation as a licence for abuse of power, corruption cannot be controlled," he says. We cannot agree more.

To see a change in this scenario, we need drastic reforms, starting with building a political consensus on the need for insulating public institutions from the influence of politics, money and criminality. The Anti-Corruption Commission (ACC) must be empowered to do its job. There should also be legal provisions to manage conflict of interest transparently, depoliticising institutions of accountability, and establishing professional integrity and impartiality of all vital institutions, including public service, administration and law enforcement agencies. We can't continue to repeat the mistakes of the past or allow the corrupt elements to eat away at the hard-earned achievements of our nation.