Saif

Senior Member

- Joined

- Jan 24, 2024

- Messages

- 15,397

- Reaction score

- 7,874

- Nation

- Residence

- Axis Group

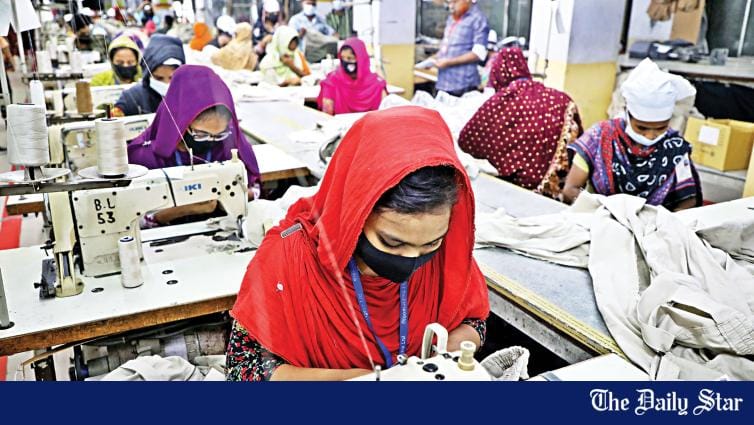

How our RMG industry empowered women

The RMG industry has provided lakhs of women, with their first formal employment opportunities.

How our RMG industry empowered women

FILE PHOTO: STAR

Over the past few decades, Bangladesh has emerged as a global hub for the ready-made garment (RMG) industry. The sector has played a pivotal role in transforming the socioeconomic landscape of the country. At the heart of this transformation is the empowerment of women, who make up the vast majority of the RMG workforce. A report by the International Labour Organisation (ILO) reveals that, as of 2020, our RMG sector employs around 32 lakh women. This sector's growth has created numerous job opportunities for Bangladeshi women, contributing to their economic empowerment while also playing a vital role in the growth of the economy.

The RMG industry has provided lakhs of women, particularly from rural areas, with their first formal employment opportunities. This shift from informal, often agricultural work, to formal employment in garment factories has had profound implications for their economic status and independence.

Earning a regular income has allowed women RMG workers to contribute to their household finances, often making them primary breadwinners. This financial independence has given them decision-making power within their families and communities. These women now have the means to invest in their children's education, healthcare, and better living conditions, leading to a positive cycle of development and improved quality of life.

Employment in the garment sector has also facilitated skills development. Many women enter the industry with little or no formal education. Through on-the-job training and experience, they acquire valuable skills in sewing, quality control, and production management. Some factories also offer literacy programmes and vocational training, further improving their capabilities and future employment prospects.

Beyond economic benefits, the RMG industry has been instrumental in fostering social empowerment of women in Bangladesh. By stepping into the workforce, women have challenged traditional gender roles and norms that often confined them to domestic duties. The presence of women in factories has gradually shifted societal perceptions of women's roles as well. As more women work outside home, the acceptance of women as economic contributors has increased.

Working in the garment industry has also facilitated greater social mobility for women. Employment has enabled women to move from rural areas to urban centres, exposing them to diverse cultures and ideas. This exposure has broadened their horizons, increased their awareness of rights and opportunities, and inspired many to pursue further education and career advancements.

However, this growth is not without challenges. Workers often face issues such as stagnated wages, long working hours, and challenging working conditions. These challenges have also sparked advocacy and efforts to improve labour rights and working conditions in the industry. Indeed, the rise of the garment sector has led to the growth of labour unions and advocacy groups fighting for workers' rights. These organizations have been instrumental in negotiating better wages, improving working conditions, and ensuring compliance with the labour law. Women workers have played a crucial role in these movements, often leading protests and strikes to demand fair treatment.

The Bangladesh government, along with international bodies and NGOs, has taken steps to address these challenges. The government had to take initiatives such as the Accord on Fire and Building Safety in Bangladesh and the Alliance for Bangladesh Worker Safety to improve factory safety standards following the Rana Plaza disaster in 2013. Additionally, programmes aimed at promoting fair wages and gender equality in the workplace have been introduced, further supporting the rights of female garment workers.

Women's increased economic participation has contributed to community development. As women invest in their families and communities, there is a noticeable improvement in areas such as health, education, and infrastructure. Empowered women are more likely to participate in community decision-making processes, advocating for issues such as clean water, sanitation, and better schools.

I truly believe that Bangladesh's RMG industry is a testament to the transformative power of employment in empowering women and lifting them out of poverty. While challenges remain, the strides made in economic and social empowerment, skills development, and advocacy for rights are undeniable. As the industry continues to evolve, it holds the potential to further enhance the lives of crores of women, driving not only the economic growth, but also social progress and gender equality in Bangladesh.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).

FILE PHOTO: STAR

Over the past few decades, Bangladesh has emerged as a global hub for the ready-made garment (RMG) industry. The sector has played a pivotal role in transforming the socioeconomic landscape of the country. At the heart of this transformation is the empowerment of women, who make up the vast majority of the RMG workforce. A report by the International Labour Organisation (ILO) reveals that, as of 2020, our RMG sector employs around 32 lakh women. This sector's growth has created numerous job opportunities for Bangladeshi women, contributing to their economic empowerment while also playing a vital role in the growth of the economy.

The RMG industry has provided lakhs of women, particularly from rural areas, with their first formal employment opportunities. This shift from informal, often agricultural work, to formal employment in garment factories has had profound implications for their economic status and independence.

Earning a regular income has allowed women RMG workers to contribute to their household finances, often making them primary breadwinners. This financial independence has given them decision-making power within their families and communities. These women now have the means to invest in their children's education, healthcare, and better living conditions, leading to a positive cycle of development and improved quality of life.

Employment in the garment sector has also facilitated skills development. Many women enter the industry with little or no formal education. Through on-the-job training and experience, they acquire valuable skills in sewing, quality control, and production management. Some factories also offer literacy programmes and vocational training, further improving their capabilities and future employment prospects.

Beyond economic benefits, the RMG industry has been instrumental in fostering social empowerment of women in Bangladesh. By stepping into the workforce, women have challenged traditional gender roles and norms that often confined them to domestic duties. The presence of women in factories has gradually shifted societal perceptions of women's roles as well. As more women work outside home, the acceptance of women as economic contributors has increased.

Working in the garment industry has also facilitated greater social mobility for women. Employment has enabled women to move from rural areas to urban centres, exposing them to diverse cultures and ideas. This exposure has broadened their horizons, increased their awareness of rights and opportunities, and inspired many to pursue further education and career advancements.

However, this growth is not without challenges. Workers often face issues such as stagnated wages, long working hours, and challenging working conditions. These challenges have also sparked advocacy and efforts to improve labour rights and working conditions in the industry. Indeed, the rise of the garment sector has led to the growth of labour unions and advocacy groups fighting for workers' rights. These organizations have been instrumental in negotiating better wages, improving working conditions, and ensuring compliance with the labour law. Women workers have played a crucial role in these movements, often leading protests and strikes to demand fair treatment.

The Bangladesh government, along with international bodies and NGOs, has taken steps to address these challenges. The government had to take initiatives such as the Accord on Fire and Building Safety in Bangladesh and the Alliance for Bangladesh Worker Safety to improve factory safety standards following the Rana Plaza disaster in 2013. Additionally, programmes aimed at promoting fair wages and gender equality in the workplace have been introduced, further supporting the rights of female garment workers.

Women's increased economic participation has contributed to community development. As women invest in their families and communities, there is a noticeable improvement in areas such as health, education, and infrastructure. Empowered women are more likely to participate in community decision-making processes, advocating for issues such as clean water, sanitation, and better schools.

I truly believe that Bangladesh's RMG industry is a testament to the transformative power of employment in empowering women and lifting them out of poverty. While challenges remain, the strides made in economic and social empowerment, skills development, and advocacy for rights are undeniable. As the industry continues to evolve, it holds the potential to further enhance the lives of crores of women, driving not only the economic growth, but also social progress and gender equality in Bangladesh.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).