Bangladesh explores energy efficiency technologies at global summit in Kenya

Young Consultants chief executive and Certified Management Consultant M Zakir Hossain has recently held a productive discussion with the Ministry of Power of Kenya and the secretary general of the International Energy Agency at the 9th Annual Global Conference on Energy Efficiency....

www.newagebd.net

www.newagebd.net

Bangladesh explores energy efficiency technologies at global summit in Kenya

Staff Correspondent 23 May, 2024, 22:18

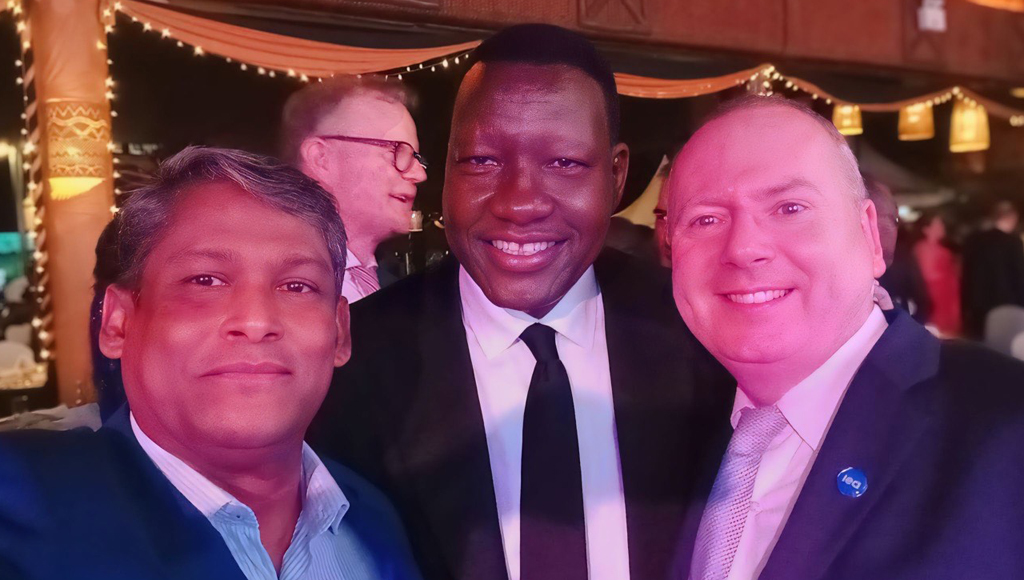

| Press release photo.

Young Consultants chief executive and Certified Management Consultant M Zakir Hossain has recently held a productive discussion with the Ministry of Power of Kenya and the secretary general of the International Energy Agency at the 9th Annual Global Conference on Energy Efficiency, said a press release on Thursday.

The event that took place in Nairobi in May 21-22 marks the first of this type of conference in Africa, underscoring the IEA's strengthened collaboration with Kenya, now an Association country of the IEA, the release said.

'The discussions cantered on how Bangladesh can leverage the latest advancements in energy efficiency technology showcased at the summit. Mr Zakir's participation highlights Young Consultants' commitment to global energy efficiency initiatives and represents a significant opportunity for Bangladesh to adopt new technologies and best practices emerging from the conference,' it read.

'As Bangladesh aims to expand its economy fivefold, the country's energy demand is expected to increase substantially. In response, the Bangladeshi government with assistance of Japan has developed the "Integrated Energy and Power Master Plan (IEPMP) 2023," outlining medium- and long-term policies to establish a low-carbon, decarbonized society,' it said.

To read the rest of the news, please click on the link above.

Staff Correspondent 23 May, 2024, 22:18

| Press release photo.

Young Consultants chief executive and Certified Management Consultant M Zakir Hossain has recently held a productive discussion with the Ministry of Power of Kenya and the secretary general of the International Energy Agency at the 9th Annual Global Conference on Energy Efficiency, said a press release on Thursday.

The event that took place in Nairobi in May 21-22 marks the first of this type of conference in Africa, underscoring the IEA's strengthened collaboration with Kenya, now an Association country of the IEA, the release said.

'The discussions cantered on how Bangladesh can leverage the latest advancements in energy efficiency technology showcased at the summit. Mr Zakir's participation highlights Young Consultants' commitment to global energy efficiency initiatives and represents a significant opportunity for Bangladesh to adopt new technologies and best practices emerging from the conference,' it read.

'As Bangladesh aims to expand its economy fivefold, the country's energy demand is expected to increase substantially. In response, the Bangladeshi government with assistance of Japan has developed the "Integrated Energy and Power Master Plan (IEPMP) 2023," outlining medium- and long-term policies to establish a low-carbon, decarbonized society,' it said.

To read the rest of the news, please click on the link above.