Saif

Senior Member

- Messages

- 15,397

- Nation

- Axis Group

Forex market steadies as dollar inflows go up

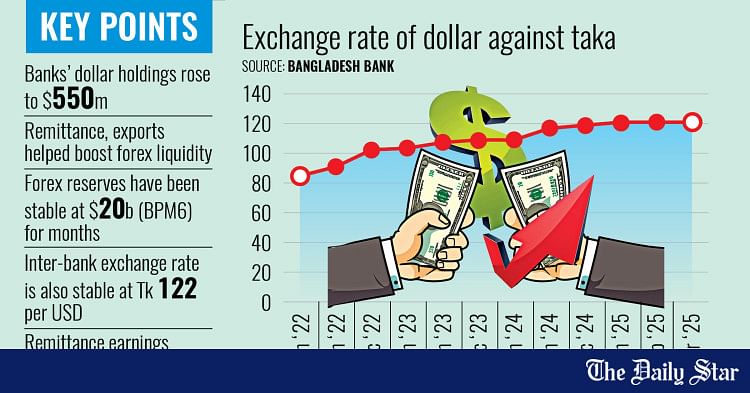

The country’s foreign exchange market is stabilising thanks to a surge in US dollar (USD) inflows, driven by higher remittances, stronger export earnings and tighter oversight by the central bank.

Forex market steadies as dollar inflows go up

The country's foreign exchange market is stabilising thanks to a surge in US dollar (USD) inflows, driven by higher remittances, stronger export earnings and tighter oversight by the central bank.

Liquidity in the forex market has improved, evident in banks' net open positions (NOP) -- the difference between their foreign currency assets and liabilities.

Banks' NOP reached $550 million as of 20 March, up from around $150 million earlier in the month, according to Bangladesh Bank data.

Over the past few months, the NOP had fluctuated between $250 million and $300 million, central bank officials said.

Industry insiders attributed the NOP increase to a rise in the inflow of the US dollar, which indicates that the foreign exchange market is increasingly gaining stability.

Bankers say remittances started to climb following the political changeover in August last year, while export growth further bolstered foreign exchange reserves.

"The forex market has stabilised in recent months due to higher dollar inflows," said Mirza Elias Uddin Ahmed, managing director and CEO of Jamuna Bank.

"Remittances have played a key role in boosting USD availability," said Ahmed.

In the first 23 days of March, remittances hit a record $2.63 billion ahead of Eid-ul-Fitr, the biggest religious festival for Muslims.

Industry insiders anticipate that the figure could reach $3 billion by the end of March -- an all-time high.

The upward trend in remittances began after the political changeover in August last year.

In September, remittances jumped 80.28 percent year-on-year to $2.4 billion, central bank data shows.

The momentum continued, with inflows of $2.39 billion in October, $2.19 billion in November, $2.63 billion in December, $2.18 billion in January and $2.52 billion in February.

According to Jamuna Bank CEO Ahmed, demand for hundi and hawala, illegal cross-border transfer systems, have dropped since authorities cracked down on those involved after the changeover. This has further funnelled remittances through formal banking channels.

"Stricter central bank monitoring has also curbed speculative trading, helping steady the market," he added.

Meanwhile, export earnings rose by 2.77 percent to $3.97 billion in February, according to the Export Promotion Bureau (EPB).

Foreign exchange reserves now stand at $20.01 billion, based on the International Monetary Fund (IMF) calculations.

The interbank exchange rate remains pegged at Tk 122 per USD -- an unofficial central bank directive.

"While banks quote rates around this midpoint, forward transactions often exceed it," Ahmed explained.

Apart from the forex market, the local currency market remains stable despite the Eid rush, according to central bank officials.

They said that except for some weak and troubled banks, the majority of banks now have excess liquidity despite significant cash withdrawal pressure ahead of the Eid festival.

The overnight call money rate, the interest on short-term interbank loans, fell to 9.95 percent on 25 March from over 10 percent a month earlier, according to central bank data, as liquidity demand eased.

The country's foreign exchange market is stabilising thanks to a surge in US dollar (USD) inflows, driven by higher remittances, stronger export earnings and tighter oversight by the central bank.

Liquidity in the forex market has improved, evident in banks' net open positions (NOP) -- the difference between their foreign currency assets and liabilities.

Banks' NOP reached $550 million as of 20 March, up from around $150 million earlier in the month, according to Bangladesh Bank data.

Over the past few months, the NOP had fluctuated between $250 million and $300 million, central bank officials said.

Industry insiders attributed the NOP increase to a rise in the inflow of the US dollar, which indicates that the foreign exchange market is increasingly gaining stability.

Bankers say remittances started to climb following the political changeover in August last year, while export growth further bolstered foreign exchange reserves.

"The forex market has stabilised in recent months due to higher dollar inflows," said Mirza Elias Uddin Ahmed, managing director and CEO of Jamuna Bank.

"Remittances have played a key role in boosting USD availability," said Ahmed.

In the first 23 days of March, remittances hit a record $2.63 billion ahead of Eid-ul-Fitr, the biggest religious festival for Muslims.

Industry insiders anticipate that the figure could reach $3 billion by the end of March -- an all-time high.

The upward trend in remittances began after the political changeover in August last year.

In September, remittances jumped 80.28 percent year-on-year to $2.4 billion, central bank data shows.

The momentum continued, with inflows of $2.39 billion in October, $2.19 billion in November, $2.63 billion in December, $2.18 billion in January and $2.52 billion in February.

According to Jamuna Bank CEO Ahmed, demand for hundi and hawala, illegal cross-border transfer systems, have dropped since authorities cracked down on those involved after the changeover. This has further funnelled remittances through formal banking channels.

"Stricter central bank monitoring has also curbed speculative trading, helping steady the market," he added.

Meanwhile, export earnings rose by 2.77 percent to $3.97 billion in February, according to the Export Promotion Bureau (EPB).

Foreign exchange reserves now stand at $20.01 billion, based on the International Monetary Fund (IMF) calculations.

The interbank exchange rate remains pegged at Tk 122 per USD -- an unofficial central bank directive.

"While banks quote rates around this midpoint, forward transactions often exceed it," Ahmed explained.

Apart from the forex market, the local currency market remains stable despite the Eid rush, according to central bank officials.

They said that except for some weak and troubled banks, the majority of banks now have excess liquidity despite significant cash withdrawal pressure ahead of the Eid festival.

The overnight call money rate, the interest on short-term interbank loans, fell to 9.95 percent on 25 March from over 10 percent a month earlier, according to central bank data, as liquidity demand eased.